Here’s Exactly How This Founder Spent $17,000 to Get Her Tea Business Off the Ground

Head of Communications & Content @ Buffer

Allison Ullo’s life took a significant turn almost a decade ago when she decided to stop consuming caffeine. In pursuit of an alternative that would rejuvenate her without the jittery anxiety and fake energy, she discovered the world of tea—but struggled to find herbal options that excited her. So, she decided to make them herself, and Leaves of Leisure was born.

The collection comprises six teas, each themed around leisure activities, infused with detoxifying, mood-enhancing, and wellness-promoting ingredients. They're designed to evoke a sense of nostalgia and joy, making every sip a delightful experience.

The process of building the business hasn’t always been so delightful, though. Allison didn’t fundraise or crowdfund because she was afraid no one would give her the time of day, and she had saved around $10,000 for the business. Unfortunately, that didn’t end up being enough. She’s learned a lot in her first year about what it really takes to get a product-based business going. Starting Leaves of Leisure forced her to move money around and change her priorities, and she still works full-time and has not one but two other jobs to sustain her life in NYC (full-time as a public relations consultant and part-time as a fit model).

But she wouldn’t have it any other way and wishes she had made the leap to start her own brand a long time ago. Outside of the company wins she’s starting to see just a year in, Allison believes the skills, knowledge, and relationships she’s gained along the way will add value to her life in so many ways.

Read on to learn more about what Allison has spent—and what she’s gained—in getting her business off the ground.

Years in business: 1

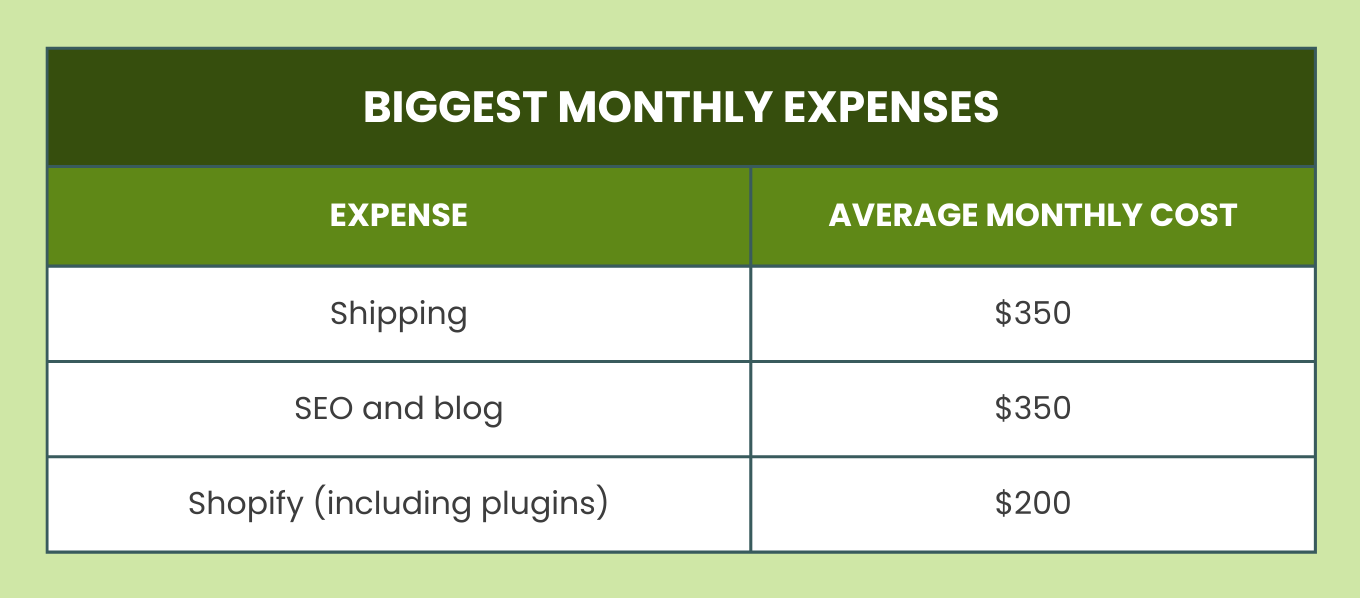

Number of employees: 1 intern, part-time help with PR, SEO and blog, and Facebook and Instagram ads

Location: New York City

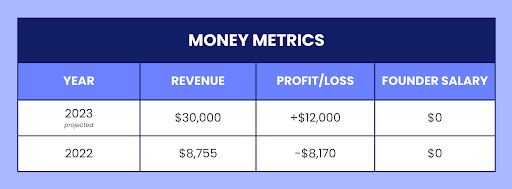

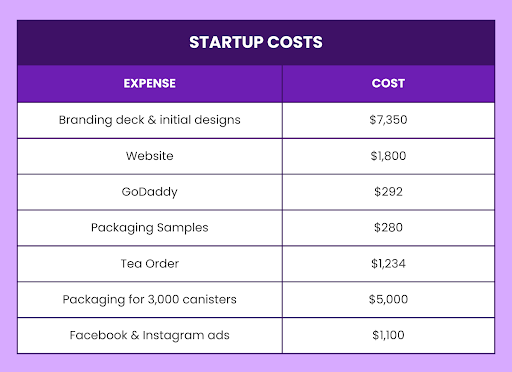

Initial capital invested: About $17,000

Financial support for business: $5,000 grant

Revenue streams:

- Direct-to-consumer online tea sales

- Marketplace sales (Walmart.com, Sune, Love.com, etc.)

- Wholesale

Growth Journey

What’s been your proudest financial achievement as a business owner?

In the fall of 2022, I won a $5,000 grant through FlutterHabit. I felt like it validated I was worthy and had started a business that was worth investing in. Getting those first sales is really hard, and I had so many conversations in the beginning that left me feeling defeated, so having my potential seen helped propel me forward. I apply for grants all the time and it is tough out there, so to finally win one was so exciting. The money definitely helped, but the time the FlutterHabit founder spent giving me advice and support was just as beneficial.

In general, the incredible connections I have made feel like the biggest win, outweighing the initial spend I put in. I have done calls with the CMO of Liquid Death for business advice, taken classes with Sophia Amoruso through her business class school, and made so many entrepreneur friends. I know these relationships will support my life for years to come, and who knows what path I may end up on because of these people I’ve met and will undoubtedly stay connected to.

What was the best investment you made to get your business started? On the flip side, what were some things you wish you had tackled more scrappily?

The branding deck and designs cost me the most upfront, and it was way out of the original budget I had mapped out. I really wanted to spend $3,000 to $5,000 max, and the woman I hired had a minimum of $7,000—but I just knew she was the right person to help me bring my vision to life. Besides being impressed by her case studies and past designs, I really liked her process of understanding the target customer, analyzing competitors, and mapping out where Leaves of Leisure could stand out and be the star. Plus, she loved tea herself, so she really understood what I was trying to do.

I am fully bootstrapped so the choice was either to go with someone less expensive (but maybe not get the results I wanted) or to pull money from my own savings to expand the budget. To this day, the packaging is what I get the most compliments on, so it was absolutely worth it.

On the flip side, I did Facebook and Instagram ads with someone who was recommended because he was affordable—and ended up making one sale for $1,100. Outside of making me wary of ads (I’ve since found more success with brand partnerships, public relations, and networking), I learned not to hire people just because they are cheap. Instead, hire them because they believe in your brand and what you are doing.

How do you decide how much to pay yourself versus invest back in the business? How have you personally made ends meet while getting your business off the ground?

Because I still work full-time in my PR consultancy, I do not pay myself or plan to anytime in the next year or so. I decided early on that, for the first three years, I would invest everything back into the business.

I currently have the energy and bandwidth to build the tea company and do full-time PR consulting, and they actually compliment each other because I can do PR for the tea company alongside my other clients. By putting all the money back into the business, I have a greater chance of scaling the company faster, which is the most important goal for me.

Once I have enough money coming in that I can see the real scale, I will start paying myself and taking a step back from my other jobs. For me I think that’s when the company hits the six-figure mark and has steady year-over-year growth.

Tell us about your team. At what point did you decide to hire employees or contractors? How do you think about when and who to bring on now?

As a solopreneur, my company is primarily a one-woman show. However, I’ve engaged an intern seasonally to assist with social media efforts and recently hired an SEO specialist to bolster our blog’s performance.

My approach to hiring is driven by a simple principle: If it’s something I don’t have expertise in or if it would free up my time to focus on broader growth strategies, I consider bringing someone on. I’m always eager to surround myself with individuals who are not only more knowledgeable than I am but who also share a passion for the brand’s success.

What specific strategies or marketing techniques did you employ to attract your first customers or clients?

I immediately leveraged my background in PR and strategically offered our teas as gifts to editors, aiming to secure feature stories that would drive traffic. Each press hit brought traffic and a few sales. Normally press hits bring in success for about a week before dying off, so it was a great way to start getting in front of customers, but it wasn’t a long term solution for getting consistent traffic.

Simultaneously, I delved into networking groups, connecting with fellow female entrepreneurs who shared a similar vision. These connections led to collaborations and giveaways, which played a pivotal role in our initial customer outreach.

What are a few of your most impactful growth strategies now?

Currently, my focus is directed toward forging marketing partnerships with other brands, from mutually beneficial discounts and product swaps to in-person events at farmers’ markets and holiday markets. For example, this summer we partnered with FrutaPOP to launch a tea-infused ice pop.

These collaborations have proven highly effective in extending our brand’s reach and customer base.

What’s a turning point that really impacted how you thought about your business or approached growth?

Early in my entrepreneurial journey, I expected that growth would come swiftly and effortlessly. However, reality quickly set in. Frustration mounted as I lost money on ineffective Instagram and Facebook ads, grappled with an overwhelming influx of advice, and confronted the sheer workload required to sustain the business, all while still working another job.

It was an enlightening turning point. Instead of rushing, I opted for a more measured approach. I realized I didn’t need to grow at someone else’s pace or to compare myself to other brands or entrepreneurs. Now, I make clear and measurable goals for each month that are attainable for where I am now from a budget perspective and a time perspective.

What have been the greatest growth or money challenges you’ve experienced? How have you worked through them?

I feel like every month I have a breakdown about money. Because I am bootstrapped, every cent matters, and I care so deeply about succeeding. I still haven’t paid myself back my initial investment, so I am very cautious about the money choices I make.

Whenever I feel overwhelmed by finances, I take a step back and think about where I can cut back and what I need to drive more traffic in an organic way. Summer has been slow as it’s not traditionally “tea season,” so I recently participated in a revenue challenge with some other entrepreneurs where you make revenue goals and help each other brainstorm new ways to achieve them. I ended up organizing five new partnership opportunities for fall and winter and was able to secure six more wholesale accounts. July was two times better than June and then I did my first event in August, which brought in the most money to date in just a two-day timeframe.

What are your next growth goals? What do you plan on investing in to help you achieve them?

I want to grow my sales by five times by the end of the year, and I've got some exciting strategies in play. First, I'm streamlining my operations by partnering with a packaging company to efficiently pack and seal my teas. This move will free up more of my time to focus on marketing efforts. To fund this, I've been strategic in relocating my inventory to a more cost-effective warehouse with affordable shipping options.

Another significant part of my growth plan is the launch of new tea flavors and bundles just in time for the busy fall and winter season, when tea gifts are in high demand. Instead of taking out a traditional loan to support this expansion in inventory, I've opted for a crowdfunding campaign on HoneyComb Credit. This way, I can involve supporters who believe in my brand and mission, offering them the opportunity to invest and earn interest on their contribution. It not only secures the capital needed for product development but also allows us to preserve our cash resources for other essential initiatives. It's a win-win for everyone involved!

Based on your experience, what advice would you give someone who had a business like yours for growing successfully?

The most valuable piece of money advice I received when I started my business was to make sure that my pricing was accurate by mapping out my entire cost of goods sold (COGS) plus additional costs like shipping and discounts to figure out the markup I needed to add. If you price too low, you will end up losing money, and you don’t want to have to raise prices later. It is always better to lower down the line.

I wish I’d been told to do a small crowdfund before I started. The process helps you validate your idea and make pivots if need be before you invest too deeply (plus, it helps to take all the financial burden off you for upfront costs). If I did it all over again, I would crowdfund from the start without a doubt.

Try Buffer for free

140,000+ small businesses like yours use Buffer to build their brand on social media every month

Get started nowRelated Articles

🖤At Buffer, we’ve long aimed to default to transparency, a practice we believe helps eliminate inequality and gives everyone a greater chance of succeeding. Financial transparency is especially close to our hearts, which is why we’re proud to share Open Books, a series of small business owners giving us a peek inside their books in the spirit of being open about finances as well. Join us as we explore the highs, lows, and hard-won financial lessons that have paved their paths, and discover how

🖤At Buffer, we’ve long aimed to default to transparency, a practice we believe helps eliminate inequality and gives everyone a greater chance of succeeding. Financial transparency is especially close to our hearts, which is why we’re proud to share Open Books, a series of small business owners giving us a peek inside their books in the spirit of being open about finances as well. Join us as we explore the highs, lows, and hard-won financial lessons that have paved their paths, and discover how

🖤At Buffer, we’ve long aimed to default to transparency, a practice we believe helps eliminate inequality and gives everyone a greater chance of succeeding. Financial transparency is especially close to our hearts, which is why we’re proud to share Open Books, a series of small business owners giving us a peek inside their books in the spirit of being open about finances as well. Join us as we explore the highs, lows, and hard-won financial lessons that have paved their paths, and discover how