Coke vs. Pepsi by country and state: Social listening analysis

Summary

We used the social listening tool Awario to analyze conversations around Coca-Cola and Pepsi on social media to try and determine the winner of the Cola Wars as seen by the brands' global and U.S. audiences.

Of all brand wars sparked by marketers over the past century, the Cola Wars might be the most long-running and definitely the most iconic. Throughout the decades, the standoff has taken many forms and featured many, many brand allies on both sides, making the rivalry truly timeless.

Whether you choose to study the Cola Wars as told by marketing professionals, business analytics, or actual historians, there's a lot to learn. The feud is not only educational but also entertaining, which makes this brand battle everyone's favorite.

The Cola Wars do not need any more retellings, not since they got a whole documentary made about them. Neither do we aim to interpret the victories and defeats of yesteryears. Instead, we aimed to look at the legendary rivalry through the eyes of social media — the global audience the whole thing was started for.

Strategy

To determine the winner of the Coke vs. Pepsi war as seen by social media, we used our own social media monitoring and analytics tool Awario. It works by searching social media and the web for mentions of brands, campaigns, products, and whatever keywords the search is set for. The results are then analyzed by metrics such as the volume and reach of mentions, the sentiment of conversations, key topics and influencers, and many more.

By signing up I agree to the Terms of Use and Privacy Policy

To analyze the impact the Cola Wars have had on consumers, we set Awario to look for mentions of Coca-Cola and Pepsi in different languages and countries. We used Boolean search to set up queries that would encompass all the search conditions we wanted Awario to observe: multiple variations of the brand names, geotagged mentions only, and the social media platforms the posts would be fetched from.

7 weeks later, we benchmarked Coca-Cola's and Pepsi's social listening analytics against each other and by doing so compared the brands' performances globally and in the U.S. Here's what we learned in the process.

Global performance and key stats

Share of voice

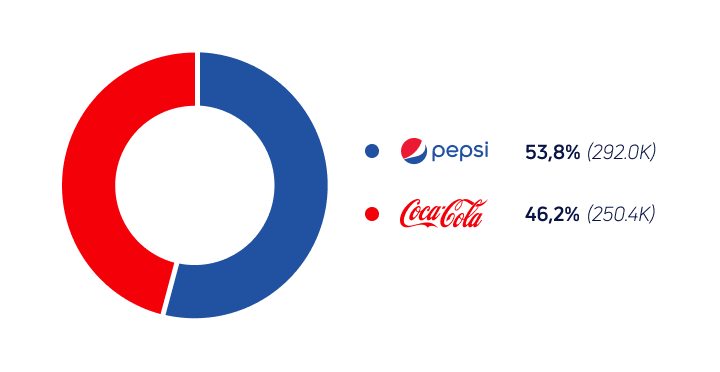

First off, we were interested to know which brand dominates the social media discussion worldwide. The brand that gets the most attention on social media — and that goes both for positive and negative mentions — has the biggest Share of voice. This metric reflects the overall visibility and brand recognition, and is closely tied to market share.

As far as the overall number of brand mentions goes, Pepsi wins by some 42K mentions. Conversations around Pepsi constitute more than half of all the mentions collected by Awario for this social listening study. This means that the brand boasts a bigger share of voice than Coca-Cola, although the victory here is by a very narrow margin.

Reach

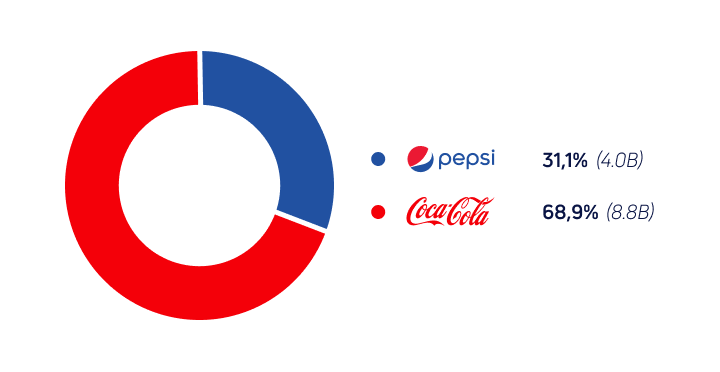

Anybody working with social media analytics will tell you that it's not only mentions' quantity that matters. Another metric that is no less telling is the posts' total Reach — the number of impressions they generated. Basically, this figure reflects the number of times social media users have been exposed to mentions of Pepsi and Coke over the past 7 weeks. And this is where things get interesting.

Coca-Cola, having lost to Pepsi in terms of the total number of mentions, wins in total reach. Over 7 weeks, mentions of Coke have generated more than two times as many impressions as mentions of Pepsi did. This goes to show how social listening metrics need to be considered in combination for a better understanding of results.

To find out why fewer mentions brought Coca-Cola double the impressions, we need to look at the authors of the mentions, specifically influencers and the media. Before we move to those, let's briefly check the social listening metrics that help us learn more about all of the authors of the mentions, influencers and the media being a part of those.

Sentiment

Now that we know all about the volume and impact of mentions, we can take a closer look at the tone behind them. After all, what's the use of the biggest share of voice if the tone of brand mentions is mostly negative?

We used the net sentiment metric that shows whether there are more positive or negative mentions, and by how much. For example, if there are 24% positive mentions and 14% negative ones, we can calculate net sentiment like so: (24%-14%) / (24%+10%) = 0.29. The fact that the number is positive tells us there are more positive mentions than negative ones; the value itself — that the positive sentiment outweighs negative sentiment by some 30%.

Let's see which tone of brand mentions — positive or negative — prevails in Coca-Cola and Pepsi mentions.

.png)

As you can see, Pepsi strikes back with a net sentiment of 30% vs. Coke's 15%. This means that positive mentions of Pepsi outweigh negative conversations by 30%, and positive mentions of Coca-Cola outweigh negative mentions by 15%.

Gender of mentions' authors

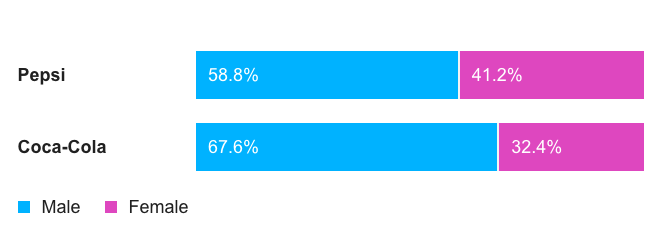

Another metric that helps us learn more about the people behind mentions is gender. For brands, knowing customer demographics is useful for putting together buyer personas. For social listening enthusiasts, gender is a cool metric to check when benchmarking brands' online performance.

Both Coca-Cola's and Pepsi's audiences on social media are primarily male. While for Pepsi the breakdown is more even (58.8% vs. 41.2%), the share of male mentioners for Coca-Cola is twice as big as female authors (67.6% vs. 32.4%).

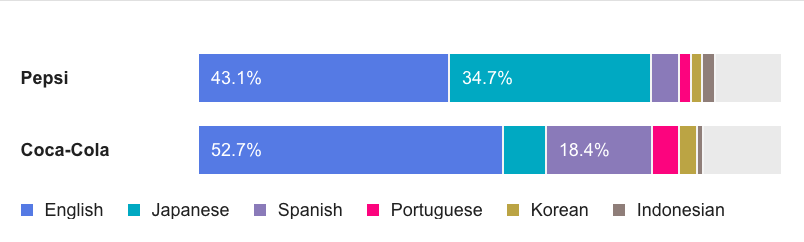

Languages of mentions

Languages of mentions is another insight that allows global brands to better understand things like coverage, online impact, market segments, and demand. Since we set Awario to look for mentions of Pepsi and Coke in multiple languages, we can examine the rivals' market segments as represented on social media.

For both brands, the biggest shares of mentions are in English. However, while for Coca-Cola mentions in English constitute over half of all the mentions (52.7%), Pepsi gets under a half of all mentions in English (43.1%), and almost as significant of a share of mentions in Japanese.

Whether the attention Pepsi is getting from Japan is due to its many, many experiments with Japan-exclusive flavors or some other factors is hard to say, but Pepsi's marketing seems to be doing right by Japanese customers who seem to love Pepsi just as much as they love talking about it on social media.

Influencers and media allies

With both Pepsi and Coca-Cola being household names for a good chunk of the past century, influencers and brand allies of all calibers have jumped on the sodas' bandwagons and led the fight on either side of the Cola Wars.

During the 7 weeks of our study alone, we spotted a great deal of media outlets, fellow brands, celebrities, and influencers manifesting their alliances on social media. For Pepsi, the media outlet with the absolute maximum reach (over 60M impressions) was vonvon.

The big names parade that follows features The New York Times, NTD Television, The Wall Street Journal, KFC, Pizza Hut, Domino's Pizza, NFL, and many others. The biggest human influencer name on the list with a reach of 16.4M was Davido Adeleke, singer-songwriter and record producer.

Meanwhile, Coca-Cola, which as we remember leads in terms of brand mentions' total reach, was championed by even bigger mentioners (in terms of their impact on social media). The list is headlined by UNILAD, Reuters, Forbes, Tasty, McDonald's, Red Bull, and, of all the entities that could be championing a global corporation, Jesus Daily.

Coca-Cola's biggest human influencer actively promoting the brand during the 7 weeks of our study was Tito El Bambino, a singer-songwriter boasting 9.3M followers on Facebook alone.

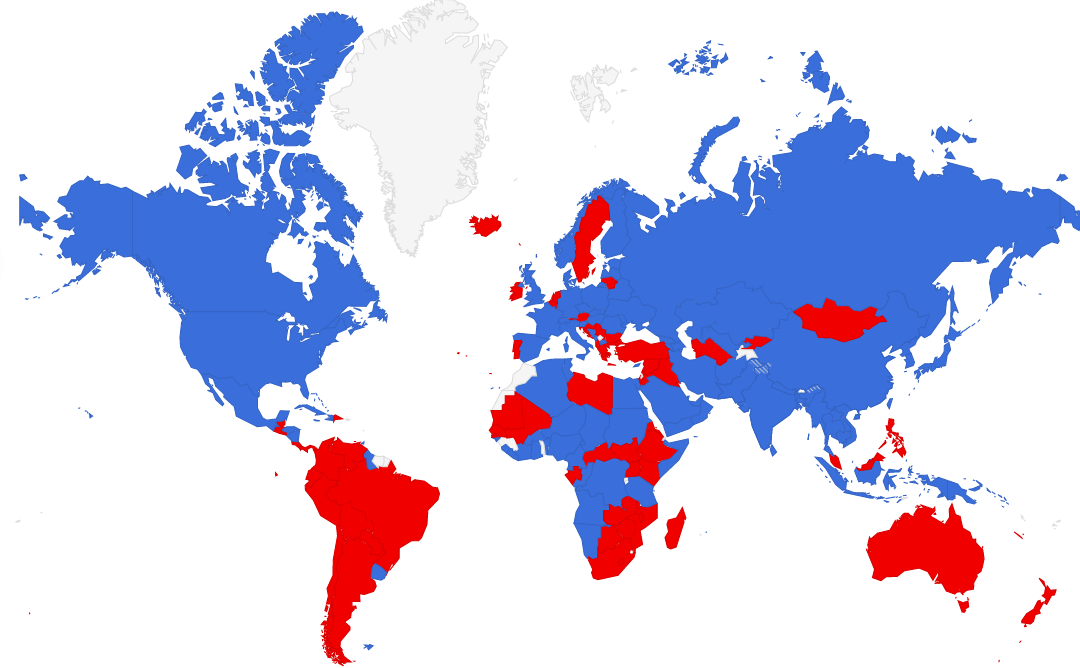

Seizure of territories

Worldwide

Having analyzed key social listening stats for all brand mentions, we wanted to visualize the Cola Wars of today and map mentions of Coke and Pepsi across the world. Depending on which brand dominated the social media discussion in any given country, we painted the world red and blue, with red representing Coca-Cola, and blue standing for Pepsi. A detailed breakdown by country is available below the map.

When we look at the country by country breakdown, Pepsi wins by 38 countries. The mentions collected by Awario during the 7 weeks of our study came from 190 countries (we set a minimum of 50 Coke/Pepsi mentions for a country to be counted in). While Pepsi won in 114 countries, Coca-Cola conquered only 76 lands.

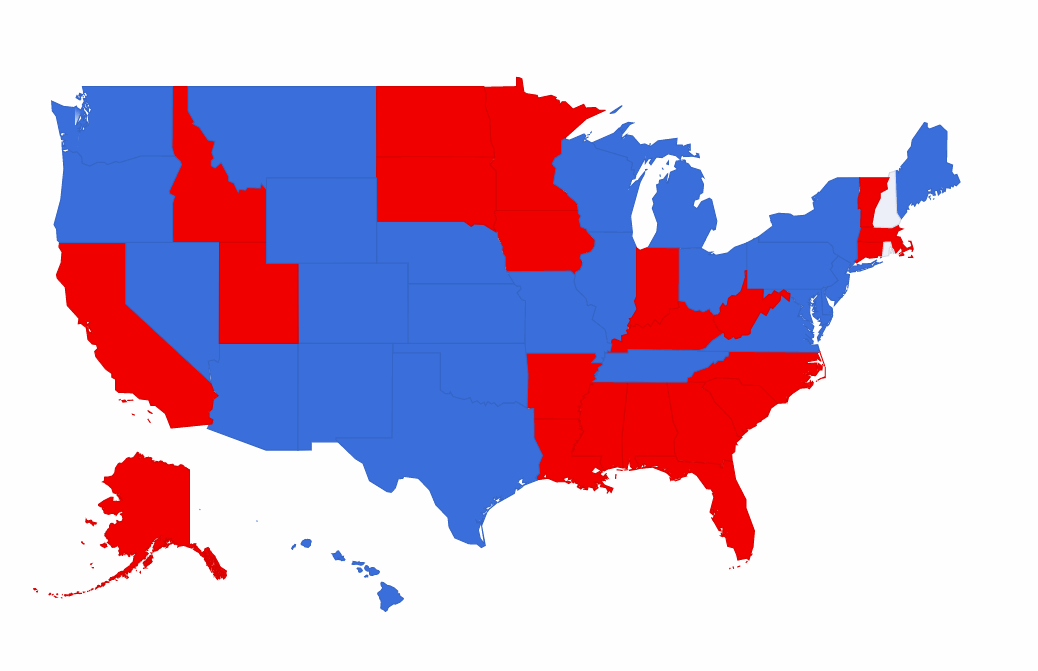

U.S.

For the final part of our analysis, we took a closer look at the mentions that came from the U.S. to map them across the states and see how Coca-Cola and Pepsi perform within a country. Not that the U.S. needs any more dividing at this time, but the country happens to be the birthplace and main battlefield of the Cola Wars.

The U.S. turned out to be divided rather evenly between the two brands. Pepsi wins by under 1K mentions and Coke wins by 4 states, and each victory is by a very narrow margin. The sharpest division within a state was observed in New Mexico: 31.64% mentions of Coke vs. 68.36% mentions of Pepsi. This is as tough as the fight gets for the soda rivals on home ground.

Do we have a winner?

We looked at the legendary rivalry of Coca-Cola and Pepsi through the lens of social media to determine the winner of the Cola Wars according to the brand's performance on social. Here's every victory we uncovered in the process:

- Pepsi wins in terms of the total number of brand mentions globally,

- Coke wins in terms of the total reach of mentions globally,

- Pepsi wins in terms of the net sentiment of brand mentions,

- Coke has Jesus on its side.

Depending on what metric carries the most significance for you, you're welcome to select the winner (but remember that a certain entity from bullet point 4 is watching you make the choice).

In all seriousness, though, the Cola Wars are iconic for their timelessness among other things. For what it's worth, we might be in for another century of the Coke and Pepsi rivalry. We'll see new brand faces, flavors, and partnerships, but social media is likely to be as divided on the Big Soda question as ever.